FX: What lies ahead for currencies in Trump sell-off?

By Erik Norland, Senior Economist and Executive Director, CME Group

Published: 27 January 2017

Currencies, bonds, equities and metals reacted strongly to Donald Trump’s victory in the U.S. elections on November 8 and Republicans retaining control of the Senate and House of Representatives. The U.S. Dollar (USD) and industrial metals soared while bonds sold off sharply on the prospects of a highly stimulative fiscal policy. If Trump’s agenda to cut income taxes and spend on infrastructure was to be enacted, it would likely expand the federal budget deficit from 3% to around 5% of gross domestic product (GDP) and offer at least a short-term boost to growth. Meanwhile, a cut in the corporate tax could prove bullish for the U.S. dollar as corporations repatriate profits held in foreign subsidiaries, and as corporations based in other countries consider the United States as a more attractive investment option.

As the various markets digest their initial post-election reaction, it’s worth examining which markets are likely to continue with their trend and which ones are likely to reverse course. In this piece, we will focus on currencies and discuss the other asset classes in subsequent articles.

Currencies

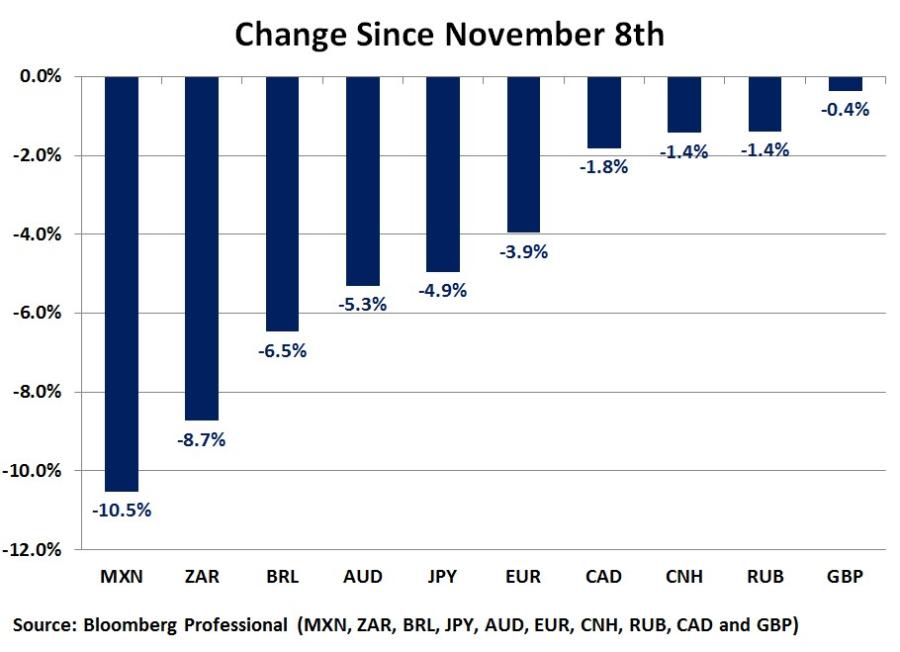

Although most currencies sold off against the U.S. dollar since the election, the degree of decline was highly variable (Figure 1).

Figure 1: Uneven Post-Election Dollar Strength.

Here is what we think is the most likely scenario and associated risks going forward:

The Mexican peso (MXN) has been hit the hardest as a result of Trump’s campaign rhetoric regarding building a wall and deporting 11 million undocumented immigrants, most of them Mexican.

Since the election, Trump has softened his tone, suggesting that his administration will deport 2-3 million undocumented immigrants with criminal records or who are criminals, and that part of the wall might actually be a fence or could simply be augmented border security.

The market has interpreted this stance as positive for MXN yet those holding short positions in the peso should be warned that Mexico has its strengths. Mexican short-term interest rates are over 5%, up from 3% in late 2015. The Mexican economy is growing at a decent pace and the peso offers an attractive carry versus USD. The peso might be significantly oversold and susceptible to a sharp rebound in coming months.

The Metals Currencies: The South African rand (ZAR), Brazilian real (BRL) and Australian dollar (AUD) have all fallen on news of Trump’s victory. All of these currencies depend heavily on the export of metals. While iron ore and copper prices soared, these currencies have fallen.

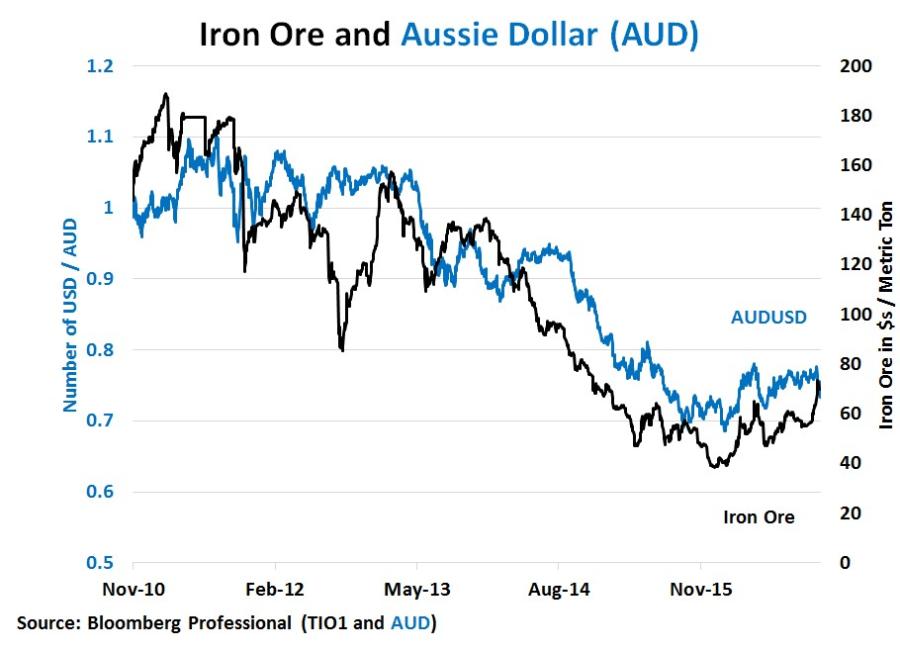

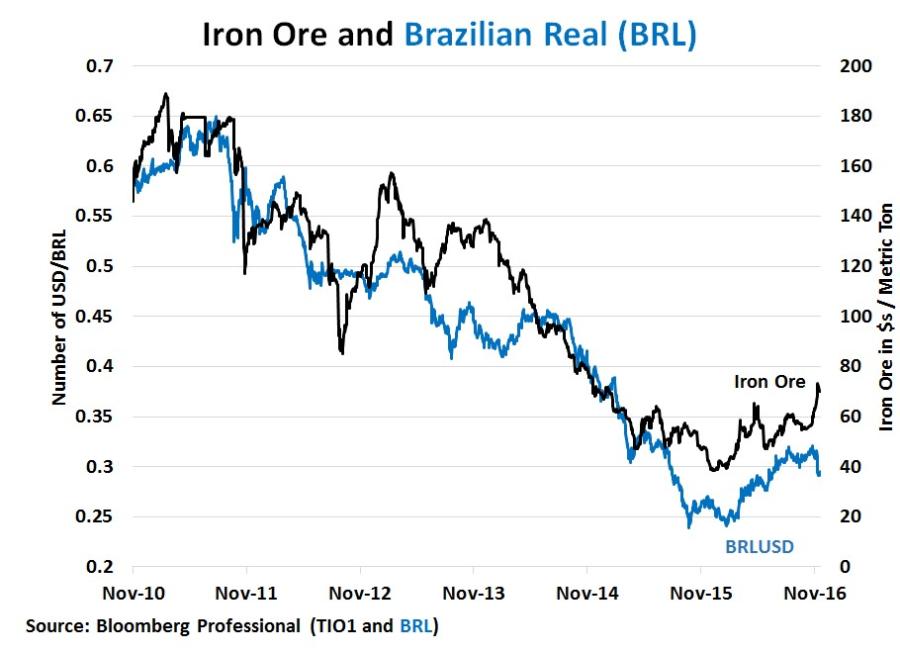

The divergence from the usual correlation patterns might offer investors an opportunity where AUD and BRL could outperform iron ore (Figures 2 and 3). While the prospect of fiscal stimulus should be bullish for both Federal Reserve rate hikes and the U.S. dollar, bigger fiscal deficits in the United States should ultimately be good news for metals exporters.

These currencies could prove to be outperformers, especially given the extremely attractive interest rate carry on BRL and ZAR. Brazil and South Africa still have messy domestic political situations, but Australia is much more solid politically and economically.

Figure 2: AUD has Fallen While Iron Ore has Risen Post-Election.

Figure 3: BRL has Fallen While Iron Ore has Risen Since the Election.

The Majors: euro (EUR), pound (GBP) and yen (JPY). The outlook for the euro, pound and yen might ultimately be more bearish. U.S fiscal stimulus probably won’t help these currencies as much as it might help commodity exporters. Moreover, Europe and Japan are still beset by problems. Japan’s total debt-to-GDP (public + private) level is close to 400%, well above that of the United States (252% of GDP). While, the Bank of Japan’s (BoJ) negative interest rate policy appears initially to have had the unintended consequence of supporting the yen by contracting rather than expanding monetary supply, the BoJ’s latest move to buy unlimited quantities of Japanese government bonds at pre-specified interest rate levels has been pushing the yen back down and may continue to do so.

Meanwhile, Europe remains a political mess. The European Central Bank (ECB) still needs to support economic growth with an easy monetary policy as Europe’s recovery is in a much earlier stage than that of the U.S. The U.S. expansion began in 2010 and unemployment has fallen by slightly more than half from 10.0% at its peak to 4.9%. By contrast, the eurozone’s recovery began only in 2013 and has been even slower than that of the U.S. European unemployment has fallen from 12% to 10%, a much more modest decline.

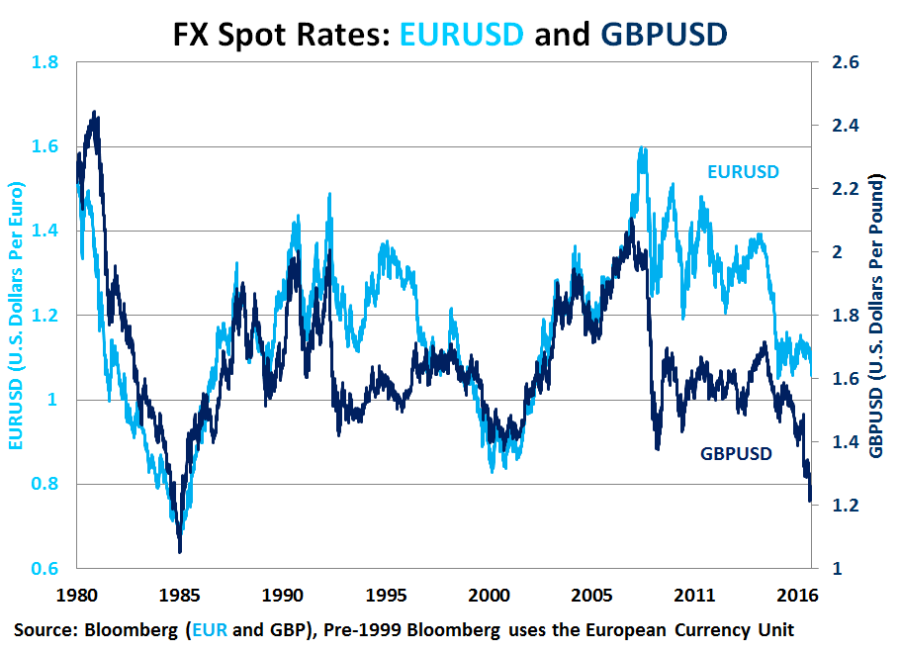

On the political front, Europe faces a series of potentially destabilizing elections beginning with the Italian constitutional referendum on December 4, to be followed by elections in the Netherlands (March), France (April, May and June) and Germany (September). Trump’s win might add to the already considerable momentum of Europe’s various nationalist and Eurosceptic parties. These elections have the potential to leave Europe with a much more fractured political landscape. If EUR breaks through its February 2015 low of 1.04 versus the U.S. dollar, it will likely test parity next and could eventually fall towards its low of 0.823 from September 2000 (Figure 4). Be warned, however, negative interest rates might be supporting EUR as much as they did for JPY, by contracting rather than expanding the money supply.

Finally, the British pound (GBP) has been relatively supported since the election, perhaps as a result of Trump’s assurances that the U.K. will go to the front of the line in negotiating a new post-Brexit trade deal with the U.S. Even heading into the U.S. election, the pound already had upside momentum stemming from a court decision that requires the Westminster Parliament to take up the issue of Brexit before Article 50 can be invoked, initiating the process of leaving the European Union. Prime Minister Theresa May is appealing this decision, which will be reviewed by the U.K.’s Supreme Court in December. While the pound may have interpreted Trump’s comments and a slightly reduced possibility of Brexit as positive, we tend to think that things could get more confused for the U.K. going forward. If the Supreme Court rules in favor of the Prime Minister, allowing her to go forward with invoking Article 50 in March as planned without consulting Parliament, we expect the pound to sell-off on the news. If the ruling goes the other way, the pound might rally temporarily, but getting Parliament involved in Brexit may make the negotiations more cumbersome and could ultimately prove bearish for the currency in the long run. Finally, the prospects for a tighter U.S. monetary policy probably won’t be helpful for GBP either. We wouldn’t be surprised to see GBP retest 1.05 versus USD, its 1985 low, in coming months (Figure 4).

Figure 4: EUR and GBP have Fallen but are Far From Historical Lows.

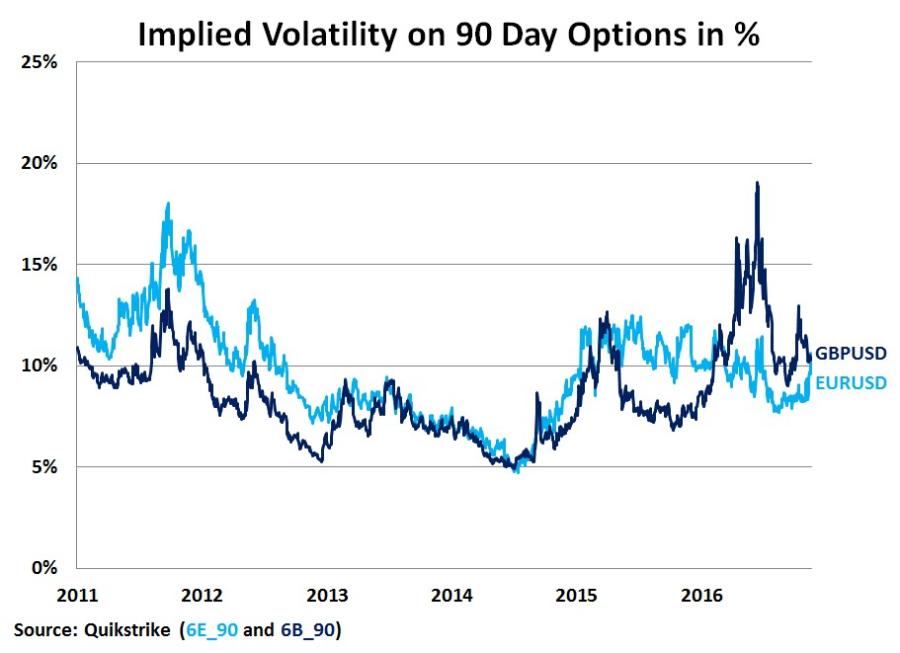

One distinct possibility is that EUR options could resume their normal pre-Brexit pattern of being more expensive in terms of implied volatility than GBP options (Figure 5). Politics in the U.K. may be messy but Prime Minister May’s government has a much more solid grip on power than do most of her European counterparts.

Figure 5: Implied Volatility on EURUSD Could Rise Significantly Versus GBPUSD.

The Petrol Currencies: Canadian dollar (CAD) and Russian Ruble (RUB): Both these currencies have been relatively supported since Trump’s election. Perhaps this isn’t too surprising. He’s never discussed building a wall between the U.S. and Canada and, indeed, the Canadian government immigration website crashed on the evening of his election. Likewise, Trump and his incoming National Security Advisor, General Michael T. Flynn, see Putin as an ally against Islamic extremists rather than as a rival. The Russian media, which is largely under Putin’s thumb, has greeted Trump’s election with glee.

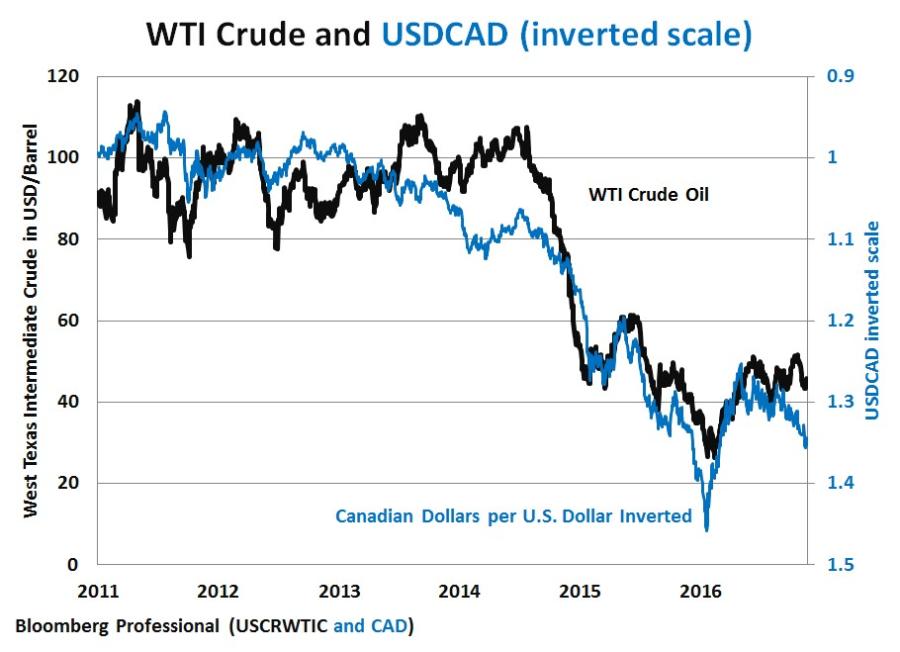

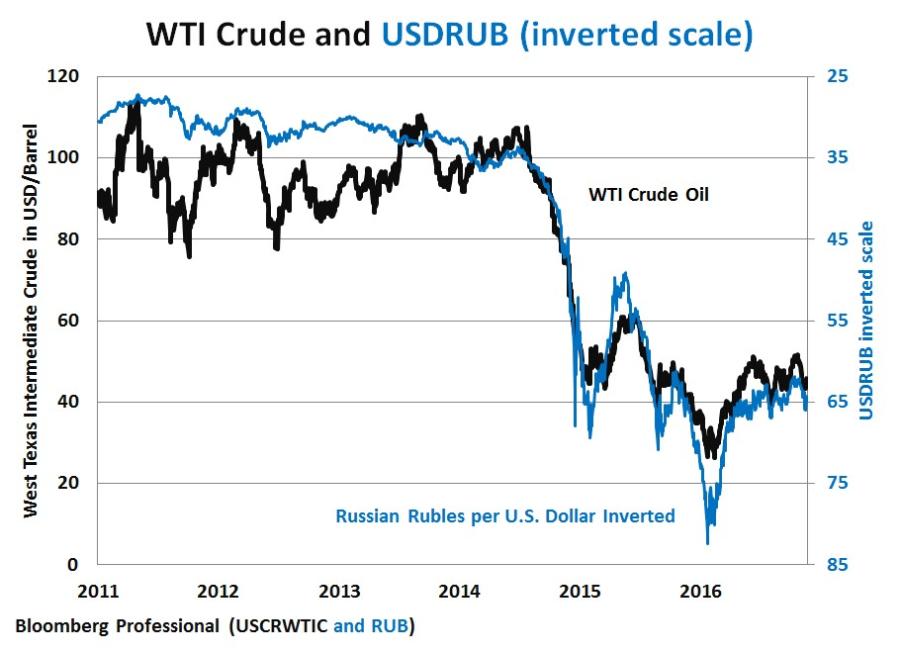

Both CAD and RUB correlate closely with oil and their prospects depend to a significant extent on the price of crude oil. The crude market is heavily supplied, with inventories still growing and Trump is favorable, at least in principle, to removing further constraints on U.S. production. These factors could prove bearish for oil prices and by extension for CAD and RUB. That said, CAD has already fallen much further than crude oil in the past few months and might become a relative outperformer versus either crude or RUB (Figures 6 and 7). On the other side of the ledger, Trump’s foreign policy team, including General Flynn and possible cabinet members Rudolph Giuliani, the former mayor of New York City, and John Bolton, the former U.N. ambassador under the presidency of George W. Bush, could take a very hawkish line towards Iran and other Middle Eastern countries.

The Iran nuclear deal decreased tensions and helped to send oil prices lower. Reneging on the deal or ratcheting up tensions with the Islamic republic or other countries in the region could have the opposite effect. It remains to be seen if Trump’s presidency will prove stabilizing or destabilizing for the Middle East and its key oil producing nations. If the Middle East becomes unstable, or if non-Middle Eastern producers such as Algeria, Angola, Nigeria and Venezuela become unstable, it could send oil prices soaring to the likely benefit of CAD and RUB.

Figure 6: CAD has Underperformed Crude and Might Outperform Oil or at Least RUB Going Forward.

Figure 7: RUB has Performed in Line with WTI Recently.

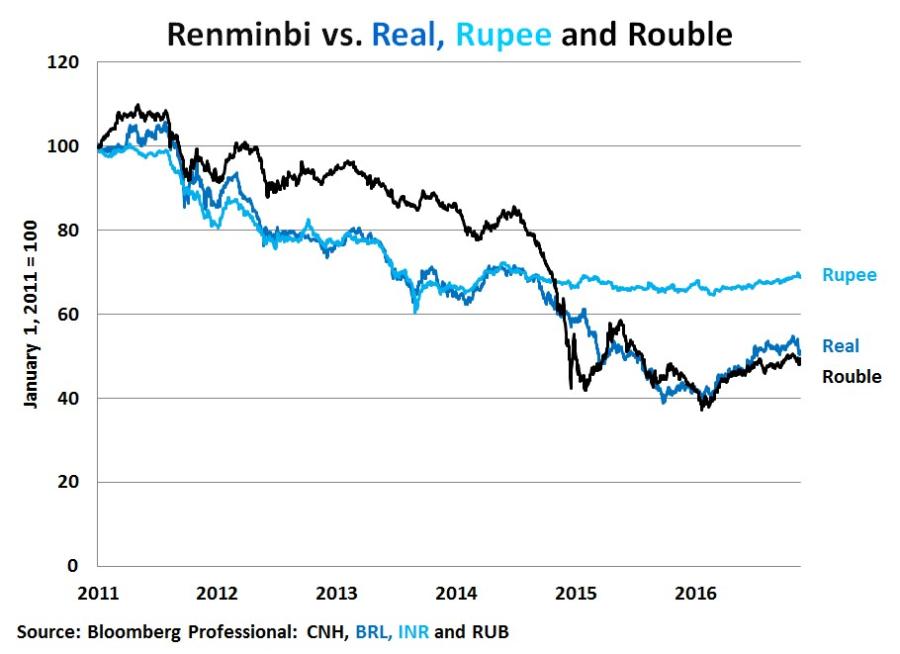

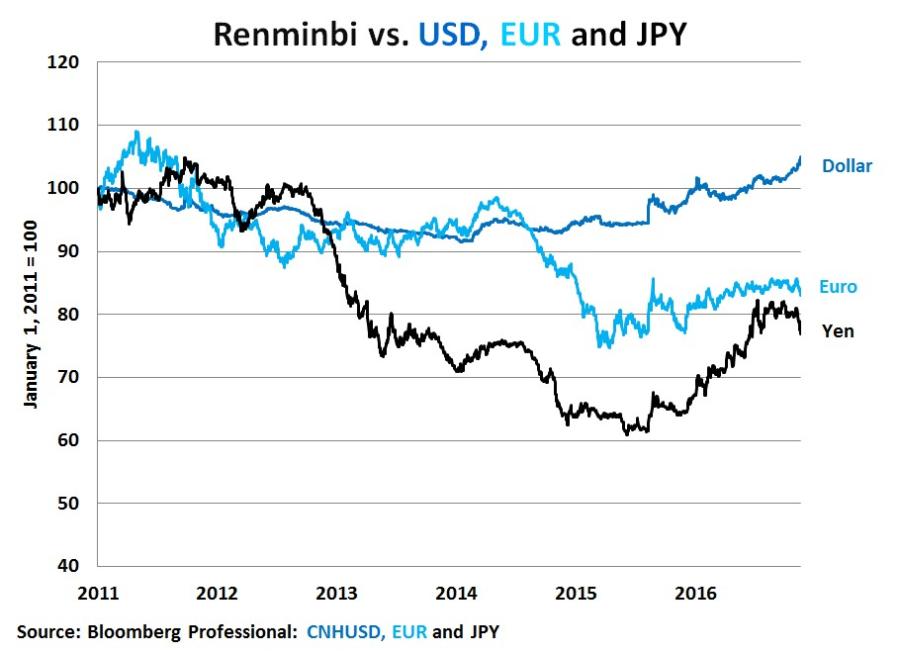

Chinese Renminbi (CNH): Trump’s election might be extremely bearish for CNH. The renminbi benefited from a brief let up in downward pressure for much of 2016 as the yen rallied and emerging market currencies recovered. Since Trump’s election, both the yen and the various emerging market currencies have resumed their downward trend (Figures 8 and 9). Trump’s tax reforms are unlikely help China much. China might derive limited benefits from a U.S. tax cut, which could modestly boost U.S. consumer demand for Chinese-made goods. Trump’s spending plans might be outright harmful to China by boosting materials prices as China is a big importer of metals and energy. Moreover, the likelihood of more Fed rate hikes will likely increase capital outflow pressures from China. At some point, China might choose to significantly devalue its currency in order to regain competitiveness. If this happens, we expect a major shock for both developing and emerging market currencies as well as commodity prices.

Figure 8: Emerging FX Resuming Downtrend vs. Renminbi Could Increase Devaluation Pressure.

Figure 9: Emerging FX Resuming Downtrend vs. Renminbi Could Increase Devaluation Pressure.

Disclaimer

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the authors and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.