Pledge fund: An à la carte investment programme

By Jean-Christian Six, Partner - Funds & Asset Management; Miao Wang, Counsel - Fund & Asset Management, Allen & Overy, Luxembourg

Published: 28 June 2021

1. What is a pledge fund?

A pledge fund is a type of pooled fund that enables each of its investors to decide, at its discretion, whether or not to participate in each investment opportunity. The commercial and governance terms of the fund must therefore be adapted in light of this investment-by-investment election arrangement.

This article intends to discuss key commercial and governance terms that a fund manager should have in mind when setting up a pledge fund.

2. Segregation of liability

An important question when structuring a pledge fund is how to segregate liabilities among the fund’s investments, so that an investor which does not participate in one particular investment has no financial exposure to it.

A pledge fund structure can be set up in the form of a limited partnership (e.g. a Luxembourg special limited partnership) where the participation of each investor is represented either by unitised partnership interests or by a partnership account.

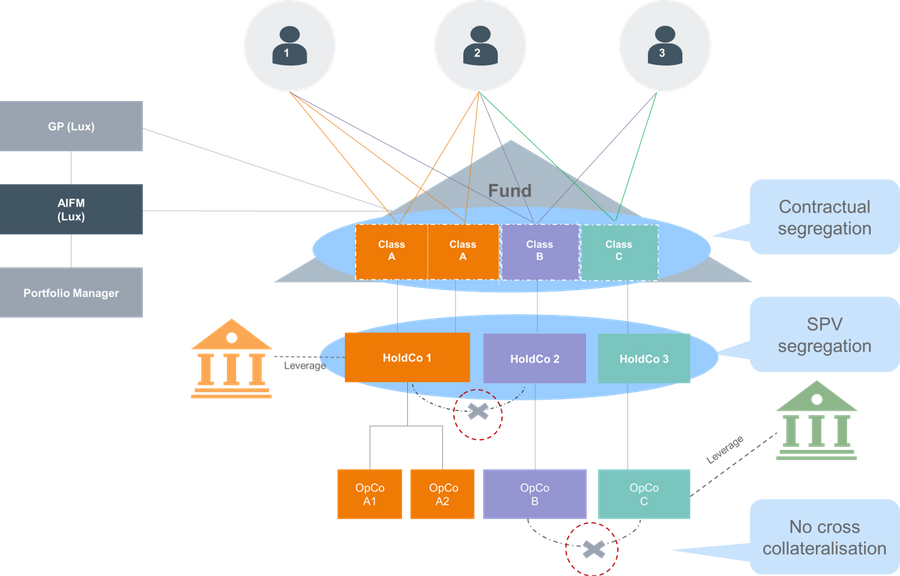

In such a setup, there are three mechanisms that collectively ensure the segregation of liabilities. Please see below a chart for reference:

- At the fund level, the constitutive documents provide contractual segregation of assets and liabilities between various pools of assets. This can be achieved for instance by issuing different classes of tracking interests/shares, each class providing exposure to one underlying special purpose vehicle (each an SPV). Investors holding one class of interests/shares have no financial exposure to the assets and liabilities allocated to other classes. Contrary to the statutory segregation of assets and liabilities of sub-funds in a Luxembourg umbrella vehicle, the segregation here is purely contractual under the fund’s constitutive documents. When dealing with a third-party (e.g. a lender) in respect of a specific pool, the recourse of the relevant counterparty must be contractually limited. In practice, it may be preferable to incur leverage at a lower level in the structure (i.e. SPV level) to avoid any cross-contamination risk (such as cross-collateral among investments).

- At SPV level, a separate SPV (owned by the fund) is set up to hold each investment to reinforce the segregation. To reduce set up and operating costs and to facilitate investment management, several investments may be regrouped under the same SPV, as long as all investors participating in the relevant investments remain the same and invest in the same investment proportion and share the same leverage exposure.

3. Investment process and governance

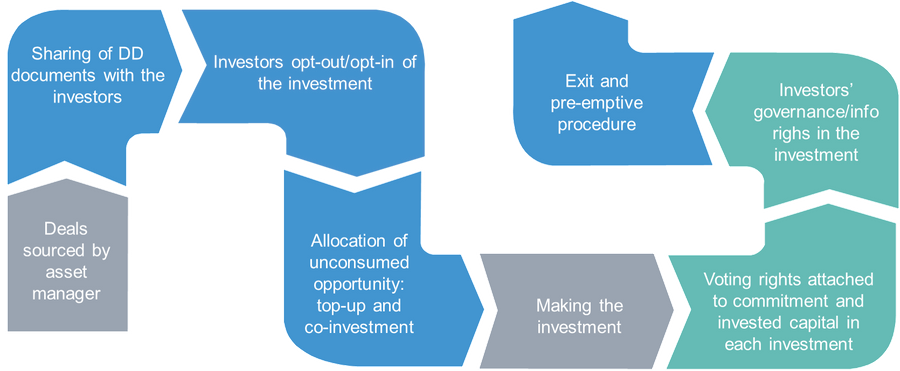

As compared to a typical blind-pool fund, the investment and divestment process of a pledge fund must be adjusted to allow for the review of each investment opportunity by investors. The process is illustrated in the following graph:

- Investment allocation

The fund manager presents each investment opportunity to all investors, usually pro rata to their commitments in the pledge fund. Each investor individually will then decide whether it wishes to participate in such an opportunity. This can be achieved either by way of an opt-in or opt-out mechanism. In the former case, investors do not participate in an investment unless they positively confirm their participation within a certain period of time. In the latter case, investors participate in each investment unless they inform the fund manager that they do not want to participate within a certain period of time.

If one or more investors decide not to participate in an investment opportunity, their pro rata portion of such investment can (depending on the terms of the fund documents) either be re-allocated among the participating investors on a proportionate basis as top-up investment and/or be offered to co-investors (i.e. existing investors or third parties) as co-investment, until such an investment opportunity is fully allocated.

- Investment information and voting rights

In order to be in a position to exercise their opt-in or opt-out rights, investors in a pledge fund will usually have access to due diligence materials and other relevant information relating to potential investments.

In addition, investors may ask for specific consultation/consent right for certain investment governance matters. Unlike matters relating to the fund’s operation as a whole where classic voting proportion (e.g. pro rata to investors’ commitments) applies, with respect to investments-related matters, only participating investors would have voting rights (pro rata to their capital contribution in relation to the relevant investment).

The fund manager must therefore seek to strike the right balance between efficient management of the investments on one hand, and investors’ information sharing and governance on the other hand.

- Exit: right of first refusal

During the exit phase, the fund manager may provide a right of first refusal enabling investors participating in an investment to purchase the relevant asset from the fund. The right of first refusal can be exercised via a bidding process and/or on a base price determined pursuant to an agreed valuation method.

4. Adapted economic terms

To match the ‘cherry-picking’ arrangement in a pledge fund, certain economic terms of the fund must be adjusted compared to a typical blind-pool fund.

- Equalisation

In a traditional PE-style closed-ended fund, subsequent investors must pay contributions to the fund to equalise all investments made before their admission as if they had been admitted to the fund at the first closing. In a pledge fund, subsequent investors do not necessarily equalise all existing investments. Instead, the equalisation on an existing investment may be subject to the consent of both subsequent investors (who must elect to participate in such investments) and existing investors participating in such investment (who must agree with the dilution of their participation in such investments). This may involve discussions on the valuation of existing investments.

- Distribution and return of distributions

Unlike the ‘fund as a whole’ or ‘investment-by-investment' waterfall commonly used in traditional PE-style funds, pledge funds usually provide for an “investor-by-investor” waterfall, which is based on each investor’s capital contributions and returns:

- Investment proceeds and income generated from one investment will first be apportioned among the participating investors based on their capital contribution proportion in such investment.

- The amount apportioned to each such investor then runs through its own waterfall:

- First, distributions are made to such investor in repayment of its aggregate capital contribution to the fund (i.e. on a fund as a whole basis) or in repayment of such investor’s capital contribution in relation to its relevant realised investment (i.e. on a deal-by-deal basis);

- Thereafter, the preferred return, catch-up and carry interest with respect to such investor are calculated accordingly.

Limited partners giveback and general partner clawback obligations are calculated on an investor-by-investor basis by taking into account of all investments made by such investor throughout the life of the pledge fund.

5. Flexible use of pledge fund

Pledge funds offer multiple advantages. From the investors’ standpoint, they provide more control over the deployment of their capital and allow them to build a closer relationship with their fund manager and fellow investors. This may be of interest for instance to investors that wish to gain experience with investing in a certain asset class. From the fund managers’ perspective, pledge funds may potentially facilitate their fundraising in certain circumstances (e.g. for a first time fund manager or for targeting a new investor base).

If, however, some investors prefer adopting a more passive approach to their investment, this can be addressed by setting up a ‘traditional’ fund, in which investors do not have the right to review and elect in investment opportunities, to invest alongside the pledge fund.

The technology that has been developed for the structuring of pledge funds can also be used as a simple and cost efficient solution to implement co-investment vehicles, enabling fund managers to offer opportunities to all co-investors in one and the same platform, instead of setting up a separate co-investment vehicle for each co-investor or investment.