The SEC’s Private Fund Adviser Rules: Key considerations for non-US managers

By Karen Anderberg; Laurel Neale, Dechert LLP

Published: 20 November 2023

Background

On 23 August 2023, the US Securities and Exchange Commission (SEC) adopted new rules (Final Rules) under the US Investment Advisers Act of 1940 (Advisers Act) that will significantly reform the scope of reporting, disclosure and other obligations imposed on investment advisers to private funds (Private Fund Advisers).

The Final Rules have five major components, with certain rules applying only to SEC-registered Private Fund Advisers (Private Fund RIAs) and others applying to Private Fund Advisers regardless of their SEC registration status:

- Requirements to distribute quarterly statements;*

- Annual fund audit requirements;*

- Conditions for adviser-led secondary transactions;*

- Restrictions on certain activities, including charging funds for certain types of expenses; and

- Restrictions on preferential treatment of investors* Applies to Private Fund RIAs only

The compliance date for the Final Rules will be staggered based on the Private Fund Adviser’s level of private fund assets under management (Private Fund AUM) as defined in Form ADV and Form PF. Certain rules1 will come into effect on 14 September 2024 for Private Fund Advisers with at least US$1.5 billion in Private Fund AUM, with the remaining rules coming into effect on 14 March 2025 for all Private Fund Advisers. These implementation dates may be delayed, depending on the outcome of litigation regarding the Final Rules.2

General applicability to non-US managers

Although a large volume of material has been produced examining the implications of the Final Rules, most of the analysis to date has been from the perspective of US-based Private Fund Advisers.

Overall, the Final Rules will have limited impact on managers whose primary office and place of business is located outside the United States (Offshore Advisers), and this is the case even if the Offshore Adviser is registered with the SEC as an investment adviser (an RIA).

The SEC confirmed in the Final Rules’ adopting release3 that with respect to the Final Rules the SEC staff will follow its longstanding position of not applying substantive provisions of the Advisers Act to Offshore Advisers with respect to their non-US clients (and a fund domiciled outside the US is a non-US client, whether or not it has US person investors in it).

The practical implication is that for most Offshore Advisers, the Final Rules will only apply to their US-domiciled private funds (e.g., Delaware funds). Nevertheless, several interpretive questions remain for Offshore Advisers, which we will examine briefly at the end of this note.

As a threshold matter, many Offshore Advisers are still grappling with how the Final Rules will apply to their business. There are various instances where an Offshore Adviser will come within scope of the Final Rules. Offshore Advisers may be able to determine that they are outside the scope of the Final Rules by asking three key questions.

- Is the fund a ‘private fund’ covered by the rules?

The Final Rules apply to ‘private funds’ which is any fund that would be required to register under the US Investment Company Act of 1940 (1940 Act) but for the exceptions under Section 3(c)(1) or 3(c)(7) of the 1940 Act. Most investment funds that are privately placed in the US rely on one of these exceptions.

Funds that are not required to rely on one of these exceptions, either because they are not offered or sold to US person investors, or because they can rely on a different exception (such as certain real estate funds relying on Section 3(c)(5)) are not subject to the Final Rules. In addition, funds that are registered under the 1940 Act (also known as “registered investment companies”) are not subject to the Final Rules. The SEC also provided a carve-out for securitized asset funds (such as CLOs), which will not be subject to the Final Rules, even if they otherwise meet the definition of a private fund.

- Where is the fund domiciled?

An Offshore Adviser is only subject to the Final Rules with respect to its US clients. Under the Advisers Act, a fund is the adviser’s client (not its underlying investors), so a fund domiciled in a non-US jurisdiction is not a US client for these purposes, even if it is offered to US person investors. Absent other extenuating circumstances (see discussion below), an Offshore Adviser will generally not be subject to the Final Rules with respect to such a fund.

- Is the Private Fund Adviser an RIA?

Certain Final Rules are only applicable to RIAs. If the Offshore Adviser is not an RIA (e.g., it is operating as a foreign private adviser under Section 203(b)(3) of the Advisers Act or an exempt reporting adviser (ERA) under Section 203(l)-l or 203(m)-l under the Advisers Act), then it will not be subject to the Audit Rule, the Quarterly Statement Rule or the Adviser-led Secondaries Rule. The only rules that such an Offshore Adviser would potentially be subject to are the Preferential Treatment Rule and the Restricted Activities Rule.

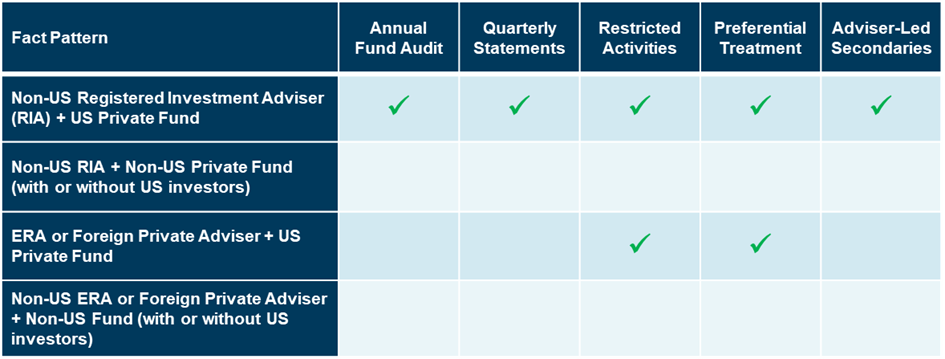

Below is a chart illustrating how the Final Rules will apply to Offshore Advisers in certain common circumstances:4

Other considerations for non-US managers

In addition to the initial question of determining whether an Offshore Adviser is subject to the Final Rules, Offshore Advisers should consider potential nuances in the application of the Final Rules, including the following:

- Does the Private Fund have a US-domiciled sub-adviser?

The appointment of a US sub-adviser could bring a non-US fund within scope of the Final Rules. If an offshore fund has a US sub-adviser and is privately placed in the United States (as discussed above), that Private Fund will be subject to the Final Rules. If the US sub-adviser is an RIA, all five components of the Final Rules will apply; if the US sub-adviser is an ERA or otherwise not registered with the SEC, only the Preferential Treatment Rule and the Restricted Activities Rule will apply.

- What if the Final Rules apply only to certain feeder funds within a Master-Feeder Structure?

Offshore Advisers to certain fund structures (such as a single master-feeder structure offering US and non-US feeder funds as different entry points for investors) may find that the Final Rules apply to a US feeder fund but not to other non-US funds within the structure. Offshore Advisers will need to consider how to treat investors across the different entry points within the single master-feeder structure, taking into account legal requirements in the home jurisdictions of the Offshore Adviser and the master and feeder funds and the development of market practice on this topic over time.

There is also a possibility that investors will come to view the Final Rules as a baseline requirement, and the market may evolve so investors will expect managers to comply with the Final Rules even if a Private Fund Adviser is technically out of scope with respect to a particular vehicle.

- Potential conflicts between the Final Rules and home jurisdiction requirements for Offshore Advisers and non-US Funds

As Offshore Advisers become familiar with the details of the Final Rule, they may identify potential conflicts between the Final Rule and local requirements of the home jurisdictions of the Offshore Adviser and/or the Private Fund. Offshore Advisers will need to consider how the specific requirements of the Final Rules – for example, the requirement to disclose preferential treatment/side letter terms given to certain investors in a fund to all investors in that fund, or the requirement to calculate performance information in the quarterly statement in accordance with specific guidelines – can be reconciled with compliance requirements under local law.

We expect more detailed analyses on the interplay of the Final Rules and various local requirements for Offshore Advisers and funds to be undertaken in the near future, and Offshore Advisers subject to the Final Rules should be on the lookout for these issues as they are identified.

1. Private Fund Advisers with at least US$1.5 billion in Private Fund AUM have a compliance date of 14 September 2024 for the Restricted Activities Rule, Preferential Treatment Rule and Adviser-led Secondaries Rule. The Audit Rule and Quarterly Statement Rule will have a longer transition period to allow Private Fund Advisers additional time to implement the necessary systems and negotiate with service providers. All Private Fund Advisers must comply with the applicable rules by 14 March 2025.

2. Multiple industry bodies, including AIMA, have filed a lawsuit with the US Court of Appeals for the Fifth Circuit challenging the adoption of the Final Rules.

3. See Private Fund Advisers; Documentation of Registered Investment Adviser Compliance Reviews, Release No. IA-6383 (23 Aug. 2023) (Adopting Release) at footnote 126 and accompanying discussion.

4. Note that this chart does not cover more nuanced fact patterns, such as a private fund that is sub-advised by a US-based RIA. These types of complex situations will need to be examined on a case-by-case basis.