Asset repackaging: Applications for managers and funds

By Sean Bulmer; Katherine Tracey, Simmons & Simmons

Published: 18 March 2024

Cracks are beginning to appear in the wall of structurally higher interest rates which western economies have experienced in recent years – an environment not seen since before the Global Financial Crisis of 2008. Futures markets indicate cuts to rates starting around the middle of 2024. If so, the cracks are likely to grow and to unlock the potential for structured finance in various asset portfolios.

All else being equal higher ‘risk free’ interest rates present competition for funds as sources of return for investors. While the competition for funds from higher interest rates has increased over the last two years, so too has the demand for investment especially from investors with a focus on the net zero and wider ESG agenda. Structured products have a role to play in providing investors with a solution to enable them to appropriately access the returns available from physical assets. Funds and managers are becoming more involved in the structured finance market either as buyers or potentially as arrangers of structured debt products. Such structured products are bespoke in nature and so can also help to differentiate investment managers from the competition in a crowded marketplace.

A key building block of structured finance is asset repackaging: the transformation of a variety of underlying assets into asset backed debt instruments. This technique can be used for a range of commercial purposes including enhancing liquidity and raising financing.

This article outlines what asset repackaging is and then considers the reasons why asset managers and investment funds might use this form of structured product where they might otherwise typically use fund structures to obtain similar commercial outcomes.

What is asset repackaging?

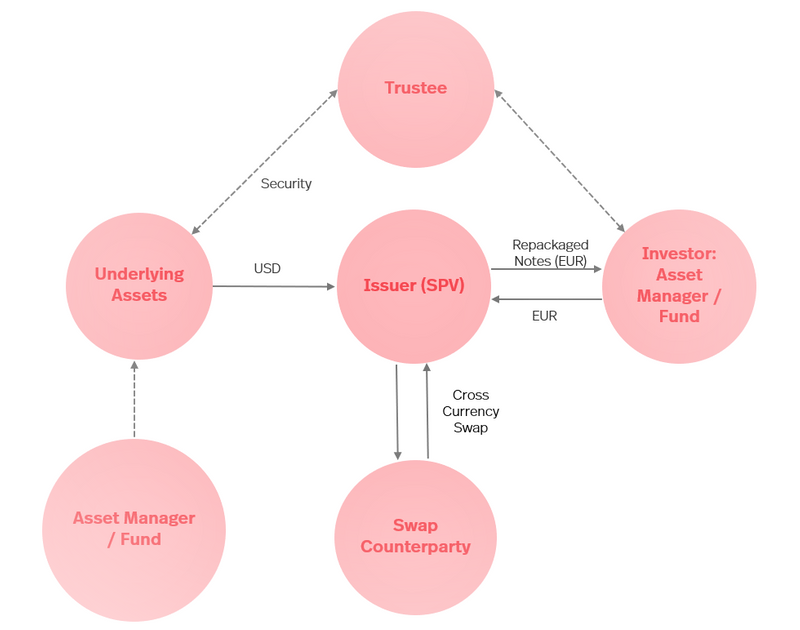

Asset repackaging typically combines bond issuance and a derivative, usually in the form of a swap transaction. A special purpose vehicle (SPV) issues debt instruments secured on specified underlying assets. SPVs are off-balance sheet companies usually set up in tax efficient jurisdictions such as the Cayman Islands, Luxembourg or Ireland. Other than the underlying assets the SPV has no other resources to make payments under the debt instruments. An investor’s recourse is therefore limited to the underlying assets (and the SPV’s rights under the swap agreement, if there is one) which are secured in favour of the trustee for the benefit of the investors thereby providing collateral for the debt instruments issued by the SPV. There is no recourse to the arranger of the asset repackaging transaction.

The debt instruments issued by SPVs can be issued in a number of forms such as notes, certificates or loans and can be listed or unlisted. The proceeds from the debt instruments are used to purchase the underlying assets. There can be a wide variety of different underlying assets; these will usually generate a cash flow for the SPV. A swap transaction exchanges the cash flow on the underlying asset for a return which enables the SPV to pay sums on the debt instruments issued by it (and those returns can be tailored to the investor’s requirements). An asset manager or fund (or possibly the investor in the debt instruments) may itself be selling the underlying assets into the structure and thereby monetising an otherwise illiquid asset. Or, they will be buying the debt instrument issued by the SPV. Asset repackaging programmes are established to allow for time and cost efficient issuance of debt instruments on a regular basis.

Range of underlying assets

A wide range of assets can constitute the underlying collateral for a repackaging transaction. Asset classes include: corporate securities, government bonds and ABS. Illiquid assets that may constitute underlying assets include loans, real estate assets and receivables. Such assets can include assets from emerging markets including: emerging market loans, securities and deposits. Examples of physical assets in repacking transactions include commodities and carbon credits. A potential growth area in asset repackaging involves cryptocurrencies and digital assets.

Why might managers and funds use asset repackaging?

There are a number of commercial drivers behind an asset manager or fund structuring a repackaging transaction and one of its benefits is the flexibility and adaptability of the basic structure to allow for the bespoke transfer of risk. Each structure will involve careful legal, regulatory and tax analysis.

Some of these reasons are summarised below:

Enhanced returns: A repackaged note can combine different physical and synthetic assets in such a way as to generate a higher return than might be available from each asset individually.

Financing: From the fund and asset manager perspective, repackaging can be a source of financing under which the value of illiquid assets may be realised more efficiently, for example by making such assets more liquid and capable of being used as collateral for other transactions or as part of a wider financing transaction. Asset repackaging may also provide an alternative means of capital raising from different investor classes who may be more familiar with, or prefer, debt instruments.

Market access: Asset repackaging can give investors exposure to risk profiles/assets not otherwise available to them. Examples of this might include:

- Where a fund is holding/illiquid/exotic assets for example private market assets, fund interests or digital assets;

- The democratisation of private or illiquid assets: offers of repackaged notes to high net worth individuals;

- The diversification of investment portfolios to include private assets in debt instrument form; and

- Providing synthetic exposure to an asset class in debt form which may not otherwise meet an investor’s investment criteria.

Operational efficiency: Asset repackaging allows an investor to hold a single financial instrument (as opposed to holding the underlying assets and hedging the transaction by entering into a separate swap) without the need for derivative reporting, or margining.

Investor demand: A repackaged debt instrument can be structured either physically or synthetically to provide investors with a specific risk / return profile not otherwise available in the market.

Asset allocation: Allocation of illiquid assets such as a loan by an asset manager or fund to individual funds/sub-funds. Asset repackaging allows an SPV to structure the original exposure to the underlying asset for the benefit of individual funds.

Wider distribution: Certain funds may have investors who want access or exposure to an asset held by the fund but they want the exposure in the form of a debt instrument rather than a fund share. Repackaging can be used to offer exposure to a wider range of investors.

Transferability/liquidity: Debt instruments issued by SPVs in the context of an asset repackaging are freely transferable (which may be of particular benefit when the underlying asset is illiquid). Investors may want exposure to assets in a securitised form where such securities are rated and/or listed.