SEC Amendments to Form ADV and the 'Books and Records' Rule under the Advisers Act

By Clifford Cone, Partner, and Ashwini Habbu, Associate, Clifford Chance

Published: 14 October 2016

On 25 August 2016, the US Securities and Exchange Commission (SEC) adopted amendments to Form ADV and Rule 204-2 (the “Records Rule”, and together, the “Amendments”) promulgated under the US Investment Advisers Act of 1940, as amended (the “Advisers Act”). Originally proposed by the SEC on May 20, 2015 (the “Proposing Release”), the Amendments make notable changes to the information required to be disclosed on Form ADV as well as expand advisers’ recordkeeping requirements.

In its adopting release (the “Adopting Release”), the SEC refines the concept of “umbrella registration” by a family of advisers, increases disclosure requirements in respect of advisers’ separately managed account (SMA) businesses, requires more information on the identity of certain third-party service providers, and instructs registered investment advisers (RIAs) to keep more records of communications and other written material that contain performance information. Compliance with the Amendments will be required on 1 October 2017.

I. Form ADV

Umbrella Registration

Per its guidance in two no-action letters,1 the SEC staff took a position that, under certain circumstances, it would not recommend enforcement against an investment adviser that filed Form ADV on behalf of itself and its affiliated advisers. In principle, the advisers could use an “umbrella” registration only if they controlled each other (or were under common control) and operated a single advisory business, among other conditions. The SEC explicitly endorsed that guidance in the Adopting Release and imposed a series of conditions that are consistent with the ABA Letters. Indicia of a single advisory business include a common group of advisory services and clients, uniform application of the Advisers Act and its rules to each adviser in the business and an enterprise-wide compliance program.

The SEC declined to extend umbrella registration to either non-U.S. filing advisers2 or “umbrella reporting” by exempt reporting advisers (ERAs), but did not, however, withdraw certain “Frequently Asked Questions”, in respect of which an ERA may file on behalf of one or more special purpose vehicles.3

In connection with umbrella registration, investment advisers will be required to file a new “Schedule R” in respect of each adviser that relies on a filing adviser’s Form ADV. Schedule R requires information about each relying adviser, including: (i) its identifying information (Section 1); (ii) the basis of its registration (Section 2), (iii) the form of its organization (Section 3) and (iv) appropriate “control persons” (Section 4). The filing adviser must also indicate whether a relying adviser manages or sponsors private funds disclosed in Section 7.B(1) of Schedule D of Form ADV.4

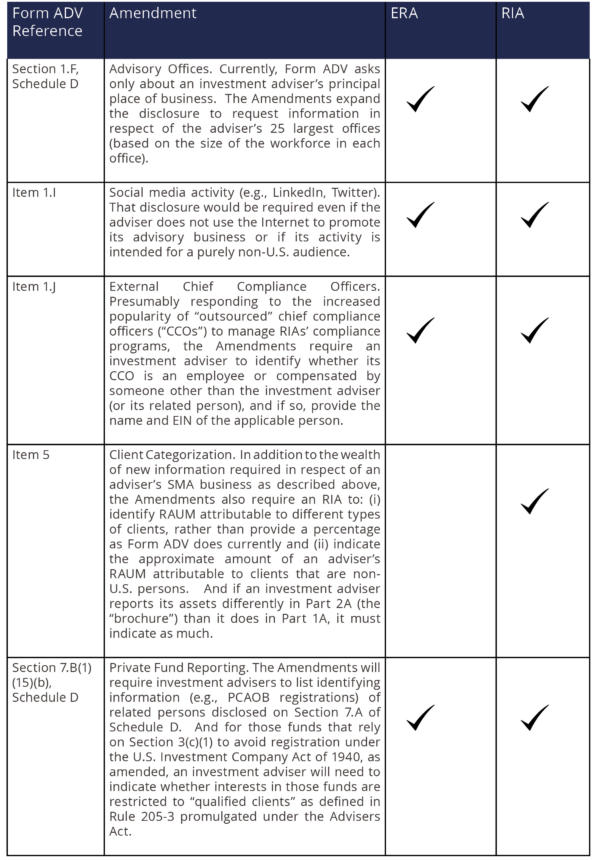

The Amendments also added a series of additional questions in respect of an adviser’s business as follows:

The principal motivation in each case appears to be to share with the general public more information about an advisory business and otherwise facilitate oversight by the SEC and its staff.

The Amendments make other, clarifying updates to the technical instructions of Form ADV. Notable examples include that:

- For Item 7 and accompanying Section 7.B of Schedule D: (i) in a master-feeder structure, indicate that feeder funds should not be counted to respond to whether any of the adviser’s “clients” were solicited to invest in fund7 and (ii) in reference to whether audited financial statements have been circulated to investors with unqualified opinions, the relevant period is the time since the adviser’s previous annual updating amendment to Form ADV.

- For Item 8, to require applicants for registration8 respond on the basis of their expectations once the adviser has the necessary RAUM.9

- For Item 9, to instruct the adviser to provide the PCAOB-assigned number of that adviser’s independent public accountant.10

- For Item 11, to amend the “Disclosure Reporting Page” (DRP) to permit ERAs to withdraw a disclosed DRP if permitted by Form ADV.

- Generally, to clarify that ERAs must update corresponding sections of Schedules A, B, C and D and provide updated contact information when submitting their respective annual updating amendments.

Separately Managed Accounts

The Amendments dramatically increase the information RIAs must provide in response to Item 5 in respect of their SMA business. Depending on the value of the RAUM attributable to SMAs they manage, RIAs must report:

- the proportion of the adviser’s assets under management that is represented by such accounts;

- the asset pools of those accounts based on a list of 12 categories;11

- the accounts’ use of derivatives and borrowing;12 and

- the accounts’ custodians.13

The SEC did not define “separately managed account”, but as in the Proposing Release, any advisory client other than pooled investment vehicles (i.e., business development companies, registered investment companies, private funds) would be deemed an SMA.

II. Records Rule

Currently, only RIAs are subject to the Records Rule, pursuant to which such advisers must maintain various written records in relation to their advisory business. Undoubtedly motivated by recent announcements of the SEC’s Office of Compliance Inspections and Examinations examination priorities,14 as well as recent orders from the SEC’s Enforcement Division that have penalized advisers for the use of misleading performance information,15 the Final Release adopts two, critical changes to the Records Rule:

- An adviser must maintain originals of any communications (sent or received) in respect of an SMA or securities-related recommendation that includes information related to performance or rate of return. Under the current Records Rule, RIAs are only required to maintain certain types of communications, including recommendations or investment advice generally, receipt, disbursement or delivery of funds or securities or in respect of the placement or execution of an order to purchase or sell any security.16

- An adviser must keep all communications to any person that explains the methodology for calculating performance information or a rate of return. The current Records Rule included a de minimis exception, whereby records were not required to be maintained if distributed to fewer than 10 recipients.17

RIAs should begin to consider revisions to their compliance policies and procedures now, including to update their IT systems and software and to train relevant personnel, so that they will be in compliance before 1 October 2017.

The SEC has adopted incremental changes to Form ADV and its staff has issued periodic guidance on various topics related to the Advisers Act, but these Amendments represent the most sweeping and substantial changes to advisers’ compliance obligations since the “15-client” exemption from registration was repealed in July 2011. Given the uptick in enforcement activity, and the breadth of the Amendments, advisers would be well served to act quickly to familiarize themselves with the new requirements.

Footnotes

[1] “Amendments to Form ADV and Investment Advisers Act Rules,” Investment Advisers Act Release No. 4091 (May 20, 2015) available at: https://www.sec.gov/rules/proposed/2015/ia-4091.pdf.

[2] “Form ADV and Investment Advisers Act Rules,” Investment Advisers Act Release No. 4509 (August 25, 2016) available at: https://www.sec.gov/rules/final/2016/ia-4509.pdf.

[3] An ERA's initial filing is due within 60 days of it achieving that status but all advisers must submit an annual updating amendment within 90 days of their respective fiscal-year ends. Assuming an investment adviser’s year-end is December 31, that adviser would be subject to the Amendments in respect of the annual update to its Form ADV filed no later than March 31, 2018.

[4] American Bar Association Subcommittee on Hedge Funds, SEC No-Action Letter (Jan. 18, 2012) (the “2012 ABA Letter”) (available at https://www.sec.gov/divisions/investment/noaction/2012/aba011812.htm); American Bar Association Subcommittee on Private Investment Entities, SEC No-Action Letter (Dec. 8, 2005) ( available at: https://www.sec.gov/divisions/investment/noaction/aba120805.htm) (together, the “ABA Letters”).

[5] Reasserting item (iii) from the 2012 ABA Letter, the SEC remains concerned that such joint filings would impede its access to, and examination of, those non-U.S. advisers.

[6] A copy of these questions can be found at: https://www.sec.gov/divisions/investment/iard/iardfaq.shtml.

[7] Form ADV, Schedule D at Question 3(b).

[8] Note: Disclosure would not be required if the social media platform was used by an affiliate only in respect of that affiliate’s business.

[9] The Glossary to Form ADV will define “United States person” to mean any natural person that is resident in the United States (consistent with Rule 203(m)-1 promulgated under the Advisers Act (17 C.F.R. 275.203(m)-1)).

[10] Form ADV, Schedule D at Section 7.B(1), Question 19.

[11] Form ADV, Item 2.A(9) and accompanying Section 2.A(9) of Schedule D (that provision will also be renamed “Investment Adviser Expecting to be Eligible for Commission Registration within 120 Days”).

[12] Form ADV, Schedule D at Section 7.B(1), Question 23(g), (h).

[13] Form ADV, Schedule D at Section 9.C.

[14] Investment advisers with less than $10 billion RAUM managed through SMAs must report this information annually, but above that threshold, advisers must report twice per year. The enumerated categories include: exchange-traded equity securities; non-exchange traded equity securities; U.S. government bonds; U.S. state and local bonds; sovereign bonds; corporate bonds – investment grade; corporate bonds – non-investment grade; derivatives; securities issued by registered investment companies and business development companies; securities issued by other pooled investment vehicles; cash and cash equivalents; and “other”.

[15] Investment advisers with SMA RAUM between $500 million and $10 billion to report the dollar amount of borrowings attributable to SMA RAUM based on three thresholds of gross notional exposures. Advisers with more than $10 billion must report the same information and exposures within a list of six types of derivatives for each SMA category (supra n. 3) twice annually. No reporting in this respect is required of advisers with SMA RAUM of less than $500 million.

[16] Only those custodians that custody 10% or more of an investment adviser’s SMA RAUM must be disclosed.

[17] Announcements of recent and related OCIE Examination Priorities can be found at: https://www.sec.gov/about/offices/ocie/national-examination-program-priorities-2013.pdf (2013); https://www.sec.gov/about/offices/ocie/national-examination-program-priorities-2014.pdf (2014); and https://www.sec.gov/about/offices/ocie/national-examination-program-priorities-2015.pdf (2015).

[18] See, e.g., In the Matter of Virtus Investment Advisers, Inc., Adv. Act. Rel. 4266 (Nov. 16, 2015); In the Matter of Raymond J. Lucia Companies, Inc. and Raymond J. Lucia, Sr., Adv. Act. Rel. 4190 (Sept. 3, 2015); In the Matter of F-Squared Investments, Inc., Adv. Act. Rel. No. 3988 (Dec. 22, 2014); see also, SEC Press Release No. 2016-167 (Aug. 25, 2016) (in which the SEC’s Enforcement Division announced penalties against 13 firms that violated securities laws by disseminating false claims made by another investment adviser), which can be found at: https://www.sec.gov/news/pressrelease/2016-167.html.

[19] 17 C.F.R. 275.204-2(a)(7).

[20] 17 C.F.R. 275.204-2(a)(16) (see also 17 CF.R. 275.204-2(a)(7)).