Cayman Islands regulatory developments – Is your fund compliant?

By Harjit Kaur, Partner, Maples and Calder

Published: 13 July 2018

The Cayman Islands has recently changed a number of regulatory provisions as part of its ongoing commitment to international standards, most notably with respect to tax transparency. Given the prevalence of the Cayman Islands as a jurisdiction for offshore hedge funds, managers and boards of such funds will need to take certain steps by specified deadlines to ensure their funds remain compliant with the various regulatory requirements.

These changes include enhancements to the Cayman anti-money laundering (AML) regime, revisions to certain aspects of the Cayman beneficial ownership register (BOR) regime, the issue of revised Guidance Notes relating to the implementation of the OECD's Common Reporting Standard (CRS) in Cayman and the introduction of Country-by-Country Reporting (CbCR) regulations to implement in Cayman the model legislation published pursuant to the OECD's BEPS Action 13 Report. Each of these developments, together with the applicable deadlines for compliance, is outlined below.

AML regime

At the end of last year the Cayman AML regime was enhanced to keep it closely aligned with the Financial Action Task Force (FATF) Recommendations and global practice. These changes, among other things, expand the scope of entities that are subject to the Cayman AML regime and expand the list of mandatory AML procedures entities in scope are required to maintain.

Expansion of scope

The recent changes mean that any entity conducting the business of "investing, administering or managing funds or money on behalf of other persons" in or from the Cayman Islands is now in scope. This term reflects wording used under FATCA and CRS in the definition of "Investment Entity", so any entity that may have been classified as an "Investment Entity" under FATCA or CRS will likely now be subject to the Cayman AML regime. As a result, Cayman unregulated investment entities previously out of scope of the AML regime are now in scope and must take steps to maintain AML procedures in accordance with the Cayman AML regulations (for example, by delegating the maintenance of their AML procedures to a third party, such as the fund administrator). The grace period for such entities to take the necessary steps to become compliant ended on 31 May 2018, so managers and boards of any such entities that have not yet addressed their AML obligations should do so as a priority.

Expansion of mandatory criteria

Cayman funds registered with the Cayman Islands Monetary Authority ("CIMA") will have been subject to the Cayman AML regime since their launch. Such funds normally satisfy their AML obligations by delegating the maintenance of AML procedures to their fund administrators. The expansion of the mandatory AML procedures entities in scope are required to maintain means that such funds will need to review, and where necessary, adjust, their existing AML delegation arrangements to ensure they remain compliant with the new requirements.

Requirement to appoint individuals as AML Officers

CIMA issued a notice in April clarifying that all Cayman entities in scope of the AML regime (including investment funds that have otherwise delegated the maintenance of their AML procedures to their fund administrator) must designate/appoint natural persons as AML Compliance Officer (AMLCO), Money Laundering Reporting Officer (MLRO) and Deputy MLRO (DMLRO and together with the AMLCO and the MLRO, the AML Officers). The same individual can act both as the AMLCO and one of the MLRO and DMLRO, so each fund will need to designate at least two individuals.

CIMA expects to release FAQs and revised AML Guidance Notes addressing the requirement to appoint AML Officers in due course. However, all existing entities in scope are required to appoint AML Officers by 30 September 2018, while all new funds launching on or after 1 June 2018 are expected to have designated AML Officers at launch. Regulated funds will be required to notify CIMA of the details of their AML Officers.

There are no particular restrictions in terms of who can be designated as an AML Officer - the principal question is whether the person performing any one of those roles is autonomous in carrying out their function. As such, employees of the fund administrator or the investment manager, members of the board, or a third party service provider can be designated as an AML Officer.

BOR Regime

The Cayman BOR regime which first came into force on 1 July 2017 requires certain Cayman companies and limited liability companies ("LLCs") to maintain a beneficial ownership register that records details of the individuals who ultimately own or control more than 25% of the equity interests or voting rights, or who have rights to appoint or remove a majority of the company directors/LLC managers at their Cayman registered office. Most investment fund entities are able to rely on an exemption, meaning they are out of scope of the BOR regime and are not required to maintain such a register. However, other non-fund entities in a fund structure such as general partner entities, Cayman management entities and holding vehicles may be in scope if no relevant exemption applies.

The BOR regime was amended at the end of last year to introduce a requirement for all entities (including Cayman funds) that are exempt to file a written confirmation prior to 30 June 2018, which must (a) identify the grounds for its exemption; and (b) provide certain additional information regarding any regulated entity or approved person upon whom the exemption relies. Managers and boards of Cayman investment funds should liaise with their registered office provider to ensure the relevant written confirmation is filed prior to the 30 June 2018 deadline. A revised confirmation is required to be filed within 30 days of any changes resulting in a change to the exemption relied on.

In addition, some exemptions available under the BOR regime have been removed and some new exemptions have been introduced. Accordingly, Cayman companies and LLCs should review any existing exemption criteria prior to 30 June 2018.

CRS

In March, certain revisions were made to the Cayman CRS Guidance Notes. The most significant change was the lowering of the threshold for the determination of "Controlling Persons" from 25% to 10%. This brings it in line with the threshold applicable under the AML regime but diverges from the 25% threshold that still applies under FATCA. Cayman funds with account holders/investors that are Passive NFEs or Financial Institutions in Non-Participating Jurisdictions (for example, Delaware feeder funds into Cayman master funds) need to collect information for "Controlling Persons" of such investors by reference to the 10% threshold with effect from 1 April 2018. An updated version of the self-certification form was issued at the same time and should be used for investors admitted on or after 1 April 2018. In addition, funds have until 31 December 2018 to conduct a back fill exercise for any pre-existing investors impacted by the change.

The revised CRS Guidance Notes also clarify that (a) an account should be closed if a self-certification is not obtained within 90 days of account opening; and (b) Cayman financial institutions being liquidated or wound up should arrange for a third party to perform any obligations under CRS which arise prior to final dissolution and which cannot be completed prior to such final dissolution. At the end of May it was announced that Cayman entities will have until 31 July 2018 (extended from 31 May 2018) to complete their FATCA and CRS reporting for the 2017 financial year without attracting any compliance measures for late filing.

Under CRS there is a requirement for all Reporting Financial Institutions to have in place written policies and procedures, and such policies and procedures should also be updated to reflect the changes made to the CRS Guidance Notes.

CbCR

The Cayman CbCR regulations were issued in December last year, with the related Guidance Notes being issued in March (together, the CbCR Laws). Investment funds are not exempt from CbCR requirements. It is therefore essential that funds undertake an analysis to determine if they are in scope.

It is expected that the CbCR Laws will impact a subset of Cayman funds, namely, funds that are part of a multinational enterprise group (MNE Group). In summary, an MNE Group is a collection of enterprises related through ownership or control such that it is required to prepare consolidated financial statements under applicable accounting principles (or would be so required if equity interests in any of the enterprises were publicly traded) that (i) includes two or more enterprises which are "tax resident" in at least two different jurisdictions or includes an enterprise that is tax resident in one jurisdiction and is subject to tax via a permanent establishment in another jurisdiction, and (ii) has a total consolidated group revenue of at least US$850 million in the preceding fiscal year. A group of entities which are tax resident in the same country will not constitute an MNE Group even if preparing consolidated financial statements. As such, managers and boards of Cayman funds that form part of a group of entities which are resident in different jurisdictions should take steps to conduct an analysis of whether the fund or any of other Cayman entities in a structure are in scope.

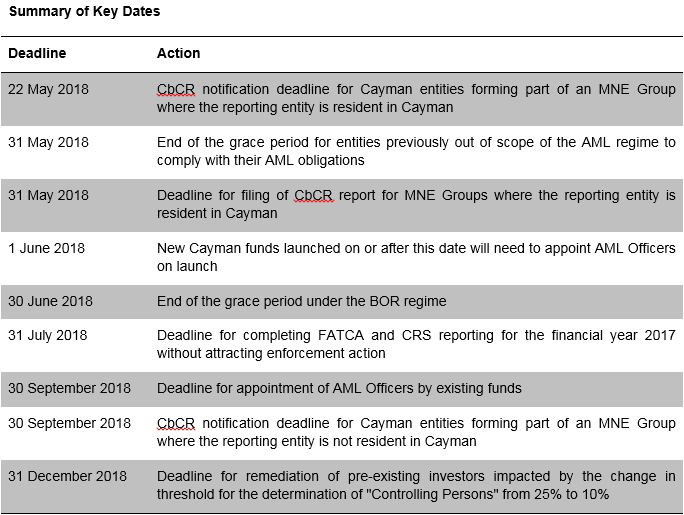

Summary of Key Dates

To contact the author:

Harjit Kaur, Partner at Maples and Calder: [email protected]

Our thanks also to Matthew Bloomfield for his assistance in writing this piece.