Distribution to investors in Switzerland

By Luis Pedro and Lisa Weihser, Oligo Swiss Fund Services

Published: 12 October 2018

Distribution to investors in Switzerland

Switzerland is an attractive market for foreign investment funds with very specific, yet easy to fulfil, requirements for distribution. Switzerland is not part of the EU, and distribution legislation is different. This article provides an overview of the current Swiss regulatory framework and contrasts it to the 2020 upcoming regulatory highlights and their impact on the fund industry. To ensure that all regulatory requirements, including representation, paying agent and regulators authorisation are met, choosing a reliable Swiss representative is essential. Once funds have been authorised for Swiss public distribution fund managers and fund distributors will expand the scope of potential investors through access to big Swiss distribution platforms, including those from well-established banks.

Switzerland, an attractive market for foreign funds

The Swiss fund market is the 5th largest in Europe, with a total volume of CHF 1134.4 billion (as of 20 August 2018)1. At the end of December 2017, the total volume was CHF 1086.9 billion, which

represents an increase of CHF 163.8 billion or 17.7% year-on-year2.

With a diversified and fragmented market made up of a large number of private banks, asset management firms, family offices, fund of funds and independent wealth managers, Switzerland is the 4th largest location for asset management in Europe and is the world leader in off-shore private banking according to the Swiss Bankers Association3.

Switzerland is a politically stable and neutral country and accounts for 1.7% of the top 1% of global private wealth. Over two thirds of Swiss adults have assets in excess of USD 100,0004. 8.8% of Swiss are US$ millionaires, an estimated 2,780 are ultra-high-net-worth individuals (UHNWI) with over $50m, and 1,070 have a net worth in excess of $100 million5. These facts make the Swiss market particularly attractive for the sale of foreign investment funds. The number of funds approved by FINMA for public distribution has been constantly growing. Most of these funds follow the UCITS directive but there are also certain Alternative Investment Funds. When looking at the number of funds authorised for public distribution in Switzerland, foreign funds outnumber Swiss funds by nearly five to one (7760 vs. 1642). Luxembourg and Ireland are the most prevalent domiciles for foreign funds, with over 6900 funds in total, followed by France, Liechtenstein and the UK.

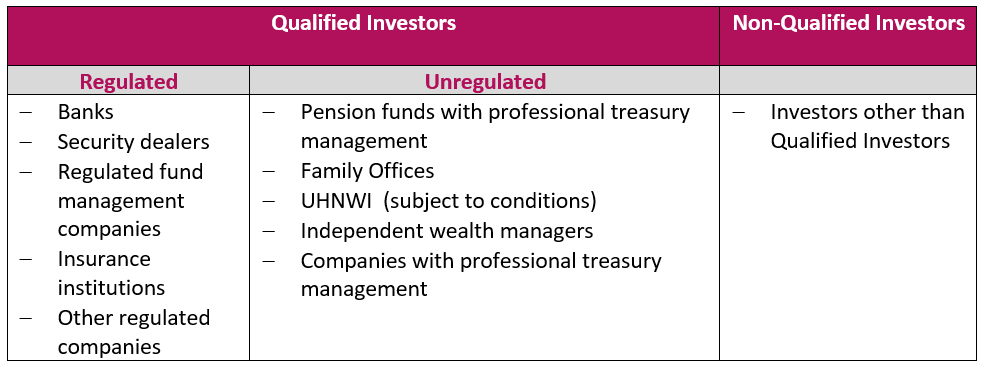

Under the CISA, the Swiss investors are segmented into groups:

The Swiss regulatory framework today

Switzerland is not part of the EU and is hence not subject to the AIFMD rules6. The distribution of foreign funds in Switzerland is regulated by a specific set of rules, where the function of the Swiss representative plays a central role. The Collective Investment Schemes Act (CISA) came into full force on 1 March 2015. The modifications introduced by the CISA require that all foreign funds distributed to Swiss investors have a Swiss representative7. For the FINMA, any activity that promotes a fund is considered distribution8.

The 2020 upcoming regulatory highlights

The Swiss Federal Financial Services Act (FFSA) and the Swiss Federal Act on Financial Institutions (FAFI) are expected to enter into force in 2020. They were drafted as a response to the 2009 financial crisis and with the purpose of meeting international standards, most importantly the recognition of the so-called “equivalence” under the “third-country rules” under MiFID II9. Through the legislative proposal of FFSA and FAFI, Switzerland envisages the harmonisation of its financial markets regulation with MiFID II in order to facilitate cross-border activity of Swiss financial institutions and to simplify the recognition of equivalence.

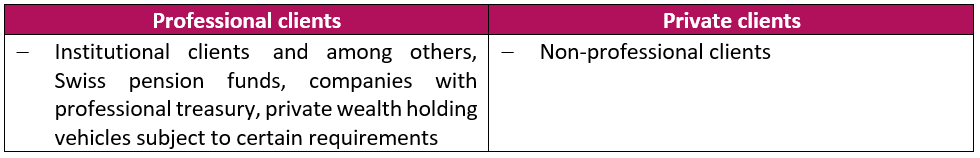

The FFSA introduces two client categories.

Also the fund industry will be affected by FFSA/FAFI, as the current licensing requirement under Art. 19(1bis) CISA, Art. 30a CISO for distributors will be abolished. Distributors will need an entry in the register for investment advisers. Professional investors under FFSA will be considered regulated qualified investors and some private investors, with financial assets exceeding CHF 500’000, that have sufficient knowledge about the risks of investments as a result of their personal training and experience in the financial sector, may “opt-out” and be considered as “professional clients”10.

With regard to prospectus requirements, the FFSA will introduce a uniform set of rules that will be applied to any securities offered publicly. The content and approval of the prospectus are inspired by the EU Prospectus Regulation11. In contrast to today’s rules, an ex-ante approval of prospectuses will be mandatory under the FFSA, except for collective investment schemes. The verification of these prospectuses will be conducted by a regulatory body which will be licensed by FINMA. Foreign prospectuses can be approved by the body as well. Those issuing for the first time will be required to submit the prospectus 20 calendar days prior to commencement of the envisaged offering of admission to trading, while other issuers are required to submit at least 10 calendar days prior. Exemptions will depend, among others, on the type of offer or on the admission of trading.

In addition to the prospectus and in line with the EU regulation on PRIIPs12, the publication of a key investor information document (KIID) is compulsory if a financial instrument is offered to private clients. KIIDs must provide all information which is relevant for an informed investment decision.

Institutional setup for distribution in Switzerland

A foreign fund authorised to distribute their funds publicly will be able to gain access to big Swiss distribution platforms, thus accessing a broad scope of potential investors. In addition to the requirement of appointing a Swiss representative and a paying agent, an authorisation from FINMA is required13.

Once a fund manager takes the decision to approach the Swiss market, the first step is generally to appoint a Swiss representative. The representative will initially discuss with the fund manager about the Swiss regulations and about aspects which are specific to the type of the fund. A list of Swiss paying agents will be provided for the client to choose from. An on-boarding process follows, which typically takes a few weeks, during which the representative executes due diligence work on the fund, a representation contract is established, and the fund’s legal and marketing documents are amended for distribution in Switzerland. This also entails filing of the documents with FINMA and requesting that the fund be authorised for public distribution in one of the Swiss official languages. This is usually not a problem, for example, for a manager from Germany, France or Italy, who already have all the fund documents in their native language, but it may be time consuming for those with documents written in other languages, e.g. managers of UCITS funds from the USA, Asia and the UK, as these financial documents need to be translated.

UCITS and Hong Kong mutual funds have a fast-track approval for distribution to private clients. FINMA has cooperation and information exchange agreements with the supervisory authorities in 17 countries14. Funds domiciled in one of these countries are also eligible to apply for public distribution and access to the big distribution platforms.

Choosing a Swiss representative

Independent firms offering representation services for foreign funds in Switzerland currently fall into two groups:

- Licensed firms that represent funds distributed to professional and institutional clients only;

- Licensed firms that represent funds distributed to all types of investors, including private clients.

Representatives that are licensed to represent funds for distribution to all types of investors, including private clients will have a deep knowledge and experience about how to proceed in the best possible way.

The role of the Swiss representative is to ensure that the funds’ distribution activities comply with Swiss laws. Some representatives evolved their services very quickly beyond simple legal representation.

In addition to the legal and procedural expertise, Swiss representatives can:

- Help fund managers who wish to distribute to private clients find the best professional translation service provider;

- Update the funds on regulatory changes and help adapting to them;

- Help gaining access to big Swiss distribution platforms, including the ones from well-established banks;

- Help building relations between funds, Swiss-based distributors and investors;

- Organise cap intro events and conferences to connect funds with investors;

- Act as a global distributor to organise retro-cessions for placement agents in Switzerland;

- Help choosing a suitable Swiss legal Counsel when required;

- Assist the fund with cross-border registration in multiple countries within and beyond Europe;

- Publish fund information and documents on electronic platforms dedicated to Swiss investors;

This makes the Swiss representative an ongoing point of reference, source of business, and long-term partner for a fund’s distribution activity in Switzerland.

For any question concerning funds representation and distribution in Switzerland, please feel free to contact Oligo Swiss Fund Services (a regulated Swiss representative for funds addressed to both professional and private Swiss investors) at [email protected].