Potential impacts on private markets of the global tariff environment and trade shock

By James Redgrave, State Street Corporation

Published: 23 June 2025

Periods of economic and market-based uncertainty are usually met with a reasonably consistent set of responses from investors.

‘Flight to safety’, from relatively high to low risk and volatility asset classes and ‘defensive positioning’ of portfolios away from investments at most risk from loss of economic growth (consumer discretionary stocks, for example).

But the current crisis has thrown up some very specific difficulties to investors trying to pursue this approach.

Most notably, the US dollar and Treasury Bill are traditionally one of the main safe havens to which investors fly. But the trade dislocation of the past few weeks generated a flight from those asset classes, raising questions about what constitutes ‘safety’ assets this time around?

The latest State Street Private Markets Study1 offers some possible answers. This is the fourth year that we’ve run this piece of research and, over that time, we’ve identified a number of long-running trends in private assets, in particular how general and limited partners (GPs and LPs) respond to difficult market conditions.

After all, our first study came out in 2022, just as the world was coming out of the global COVID recession and market crisis. The next two surveys were run against the backdrop of sharply climbing inflation and rising interest rates – an especially challenging environment for such highly leveraged asset classes as private markets.

So private markets managers and investors were already out of the 2010s mindset of low interest rates and cheap borrowing enabling a rising tide that would lift all boats. They have spent the 2020s on a trajectory of rapid innovation, driven by a combination of technology and strategic rethinking of their approach to investment selection.

The ‘flight to quality’ that we have identified in our latest survey has become entrenched in private markets approaches over this time, positioning them well for yet another environment where deals have to be analysed minutely and due diligence data led investment reporting is key.

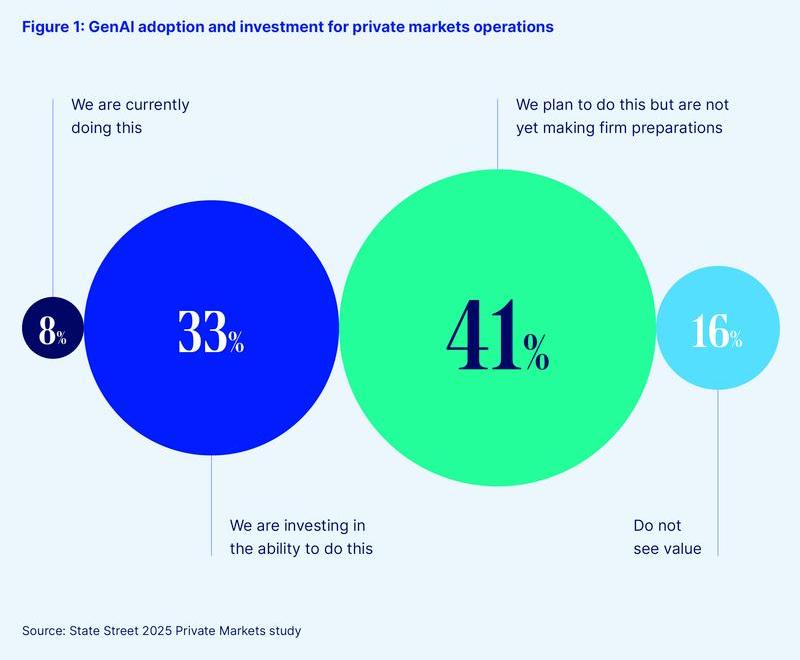

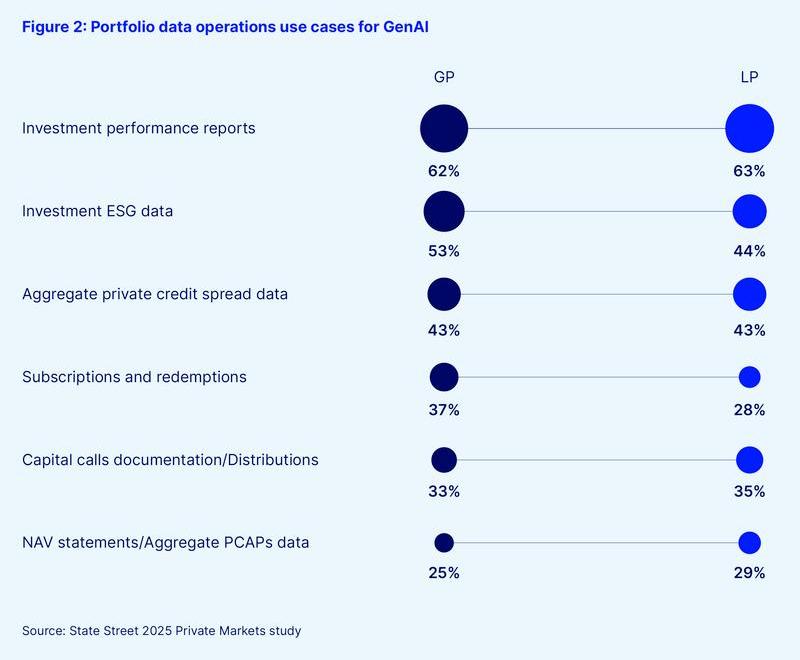

This strategic approach is no longer hypothetical. Our data shows that an overall focus on risk analysis and deal scrutiny in last year’s research, in buyside institutions’ internal investment in technology and operations, has become a series of highly specialised use cases for up-to-the-minute technologies like Generative AI (GenAI) across multiple areas of their data and operations.

In a volatile market and shrinking growth environment, it is particularly essential to understand the quality of your underlying investments and ensure that every dollar of your, or your clients’, money is being spent wisely. And this data shows that the private markets industry has been investing in systems and operations to enable this for the past five years.

For more information about how these technologies are being applied in private markets, read our industry roundtable on the topic.

There are other reasons to consider some particular private markets opportunities in this specific economic downturn.

Assuming other countries and regions don’t respond to US tariffs with similarly extensive reciprocal ones, there is likely to be less inflationary pressure in those areas, and they have the leeway to cut interest rates to support economic growth, with the additional effect of increasing access to leverage for private markets.

Real assets tend to support essential economic goals like infrastructure and are less vulnerable to consumer spending than many public markets securities. Meanwhile, many private companies operating in areas such as technology hardware and microchips with long established international supply chains that cannot be quickly redesigned face rising costs. But they will also see continued rising demand for their products based on their products’ essential integration into global economic activity, and longstanding global consumer trends.

Lastly, one of the most interesting developments in our research is the increased expectation of growth in the semi liquid fund market. More than half of our respondents now expect at least half of private markets flows to go through retail-style funds within the next couple of years.

The democratisation agenda has received considerable government and regulator support in recent years, for example the European Long Term Investment Fund (ELTIF) 2.0 and the UK Long Term Asset Fund (LTAF).

The reasons for these top down supports for democratisation are very much the same as the causes of the current trade crisis – they are seen as a means of financing onshoring and supporting domestic industries, funding domestic infrastructure, and reducing supply chain reliance between certain parts of the world. So it is reasonable to assume the trade dislocation scenario will generate increased interest and support for new private markets investment sources from governments.

Anti-growth global policy environments are never the preferred situation for capital markets, and this goes for private markets too. But there are reasons to believe that the right type of private markets holdings can be part of what safety looks like in what is likely to be a flight to safety world for the near future.

1 In the first quarter of 2025, CoreData research, on behalf of State Street, ran a global survey of nearly 500 senior executives at buyside investment institutions including private markets specialist managers, generalist asset managers with private markets portfolios, and institutional asset owners.

@2025 State Street Corporation and/or it’s applicable third-party licensor

All Rights Reserved

7993079.1.1.GBL.