Digital Assets

Overview:

Since 2017, AIMA has been a global leader in advancing digital asset initiatives. At the heart of this work is the Digital Assets Working Group (AIMA DAWG), a strategic partner to the industry and a dynamic network of senior industry professionals spanning the institutional digital assets ecosystem. This includes investment managers, allocators and fund service providers united by a shared commitment to fostering innovation and shaping the future of digital assets.

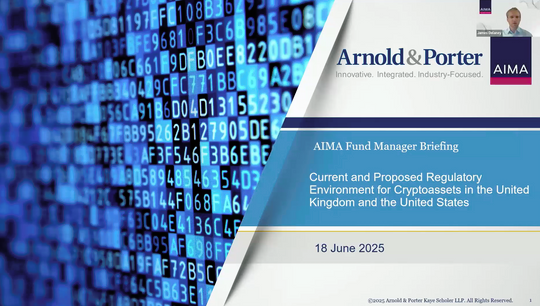

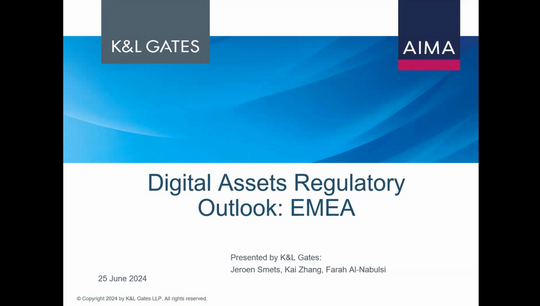

AIMA DAWG is the driving force behind the association’s thought leadership, regulatory advocacy, and the development of robust operational standards—bridging the worlds of digital assets and traditional asset management to support the sector’s continued evolution.

Through a rich programme of global conferences, interactive webinars, and regular member roundtables, AIMA facilitates meaningful dialogue among the industry’s most foremost leaders and innovators. These platforms explore not only the latest trends shaping the digital asset space but also dive into the practicalities of implementation- how firms are approaching investment, infrastructure, tokenisation and more.

With its global reach and institutional credibility, AIMA is uniquely positioned to support the growth of crypto-native firms seeking to scale, while also guiding traditional asset managers as they integrate digital assets into established investment frameworks. This dual perspective allows AIMA to act as a trusted partner across the full spectrum of the industry’s evolution.

If you would like to find out more about AIMA’s digital assets work, please contact:

• Michelle Noyes, Managing Director, Head of Americas;

• James Delaney, Managing Director, Asset Management Regulation.